Newsletter n°87

NEWSLETTER

FINANCIAL COOPERATIVE ASSOCIATION OF INTERNATIONAL CIVIL SERVANTS

N° 87 / FEBRUARY 2023

Managing your assets

Vision of Mr. Muammer Kardelen, Chief Investment Officer

The financial markets seem to be playing with optimism since last October thanks to the reopening of China, where the end of the Covid confinements gives hope for a return to normal supply chains and a recovery in Chinese and global consumption.

At the same time, the war in Ukraine of course and the military maneuvers in the Taiwan Strait are making investors so cautious as to evoke "the end of globalization" last month in Davos. The world's leading figures listed the major risks likely to hit the financial markets in 2023: first of all social risks (linked to inflation and real estate, but also to the weakening of the social contract in democracies), ecological risks (climate change and natural disasters) and geostrategic risks, of course (war, cybercrime and migration crises).

After their last increase on February 8, the surge in eurozone interest rates that began in the second quarter of 2022 seems to be slowing down, while the recent rate hike by the Fed on February 1st seems to cap, pending a clearer position in the second half of 2023, with regard to inflation.

There is still room for inflation to impact consumption and investment, making a (hopefully mild and temporary) recession in Europe and the US even more likely.

In this context, I continue to favor the safety of your money while making a large reallocation from bond mutual funds (subject to substantial observed volatilities) to direct investment grade bonds with fixed coupon and medium duration. This will give us greater visibility and stability on income, while allowing us to take advantage of the opportunities that will arise this year with the continued increase in deposits made by our members.

Capitol Mastercard Gold : a new card available in 4 different currencies!

In 2022, BIL Bank, our current credit card provider, informed us that they will not issue any new cards in the future. However, existing cards will continue to be renewed.

We therefore started discussions with other providers and entered into a partnership with Advanzia. Advanzia is a Luxembourg-based digital bank specializing in credit cards and payment solutions. It has become one of the leading providers of credit cards in Europe.

We are therefore offering our members a new Mastercard Gold card with many advantages.

This card is available in EUR, USD, GBP or CHF. The cost of this card is €100, but AMFIE will pay half of the first credit card fee, so the it will be at the preferential rate of €50, and additional cards, for example in another currency, or for a co-applicant, will be charged at €100.

Advanzia offers a mobile application that allows you to manage your expenses. You can create alerts and receive notifications for your spending, manage your spending limit, temporarily block your card in real time, or get an authorization code to validate a transaction.

Mastercard also offers rewards and cashback on your shopping and travel expenses.

Thanks to our new partner, the time for creating and sending cards will be considerably shortened. The cards will be sent from our premises, 3 days after the request.

You can find all the insurance and assistance conditions offered with the card on our website (private section Credit Card), or for any other information, please contact our colleagues amfie@amfie.org.

News from our coordinators

We wish Cécile Chavanne, who was our coordinator at the WTO until May 2022, a happy retirement.

At the FAO in Brazzaville, it is Jean-Baptiste Banzouzi-Mbika who has retired in December 2022. He remains the coordinator and will travel between Italy and Congo.

KYT (Know your transactions)

The fight against money laundering and terrorist financing has a new weapon

You are already be familiar with the term KYC (Know Your Customer), a procedure that is now widely used to analyze clients’ private details in the context of the fight against money laundering. AMFIE has the legal duty to regularly monitor the business relationship it has with each of its members, and to regularly update the information when it becomes obsolete. This is for instance the reason why our colleagues sometimes ask you to provide them with a certified copy of a valid identity document when the previous one has expired.

The 5th EU Anti-Money Laundering Directive (EU 2018/843), requires financial institutions to equip themselves with a new legislative tool: KYT or "Know Your Transaction". This involves monitoring the financial transactions requested by members (deposits and withdrawals) and checking their compliance. Aimed at monitoring transactions, the procedure can take different forms: checking the economic origin of incoming transfers, checking the issuer or receiver of payments, etc… These checks are carried out by our colleagues before accepting a deposit or making a withdrawal. If the procedure should apply to one of your transfers, our colleagues will contact you as soon as possible to execute your request as quickly as possible.

In addition to enabling AMFIE to comply with the supervisory authorities, these measures also ensure the security of its members’ assets.

New authentification AUTHY

Some of you have experienced difficulties to access their AMFIE.NET profile when using the SMS authentication system. Therefore, we have been working on an alternative login solution with a unique code that is also secure and convenient.

Since end of February 2023, we offer you an additional authentication method called "Authy".

Logging in via Authy is entirely digital and can be used with a computer, a mobile phone or a tablet.

Authy provides an application that generates a one-time code (token) to identify you and allow you to access your account securely.

To activate this new feature, you only have to create an Authy account and connect it with your amfie.net account.

This new feature has been developed for the amfie.net web interface only and does not work on the AMFIE Mobile Finance application.

We have prepared a video to familiarize those who wish to authenticate themselves with this new method, and to assist you in your first steps.

Interest rates 1st quarter 2023

As announced in the greetings, which were sent out on 10 January, the Board of Directors has decided to increase the rates for savings accounts, the rates for AMFIE Flexible and the rates for 0/18 savings accounts.

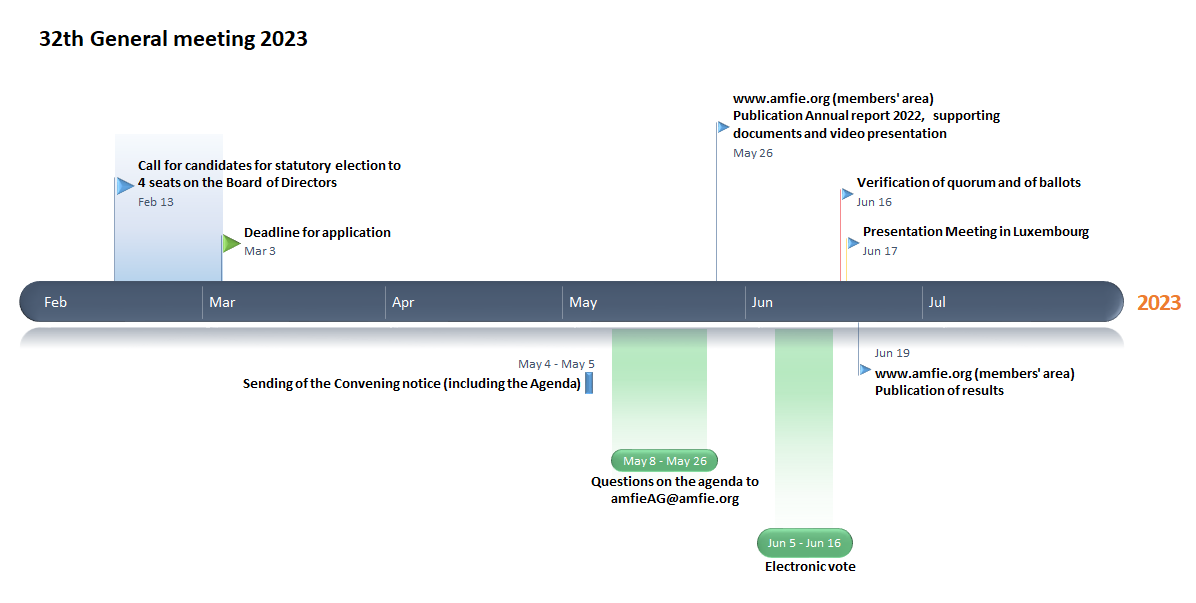

Annual general meeting 2023, Key dates!

The 32nd General Meeting will be held online from June 5th to 16 th 2023. The 2022 annual report and the results of the votes will be presented at a meeting in Luxembourg on Saturday 17 June at 10.00 am.

Each member of AMFIE may submit his or her candidacy for election to the Board of Directors. As half of the Board is renewed every year, there are 4 positions to be filled. The deadline for submitting candidacies is March 3rd, and full information on this subject will be sent out at the beginning of February.

The Convening notice, which includes the agenda of the General Meeting and the presentation of the candidates, will be sent in May.

All information related to the Annual Genral Meeting is available on this site (members' area menu General Meeting)

FIND ALL THE ARTICLES ON

https://www.amfie.org/en/amfie-academy

FINANCIAL COOPERATIVE OF INTERNATIONAL CIVIL SERVANTS

25A Boulevard Royal - L-2449 Luxembourg

Tel (+352) 42 36 61 1 - Fax (+352) 42 36 61 240

E-mail : amfie@amfie.org - Site internet : www.amfie.org